Beyond KPIs: How CFOs Are Adopting Predictive Performance Indicators (PPIs)

Guest article by Padmapriya V

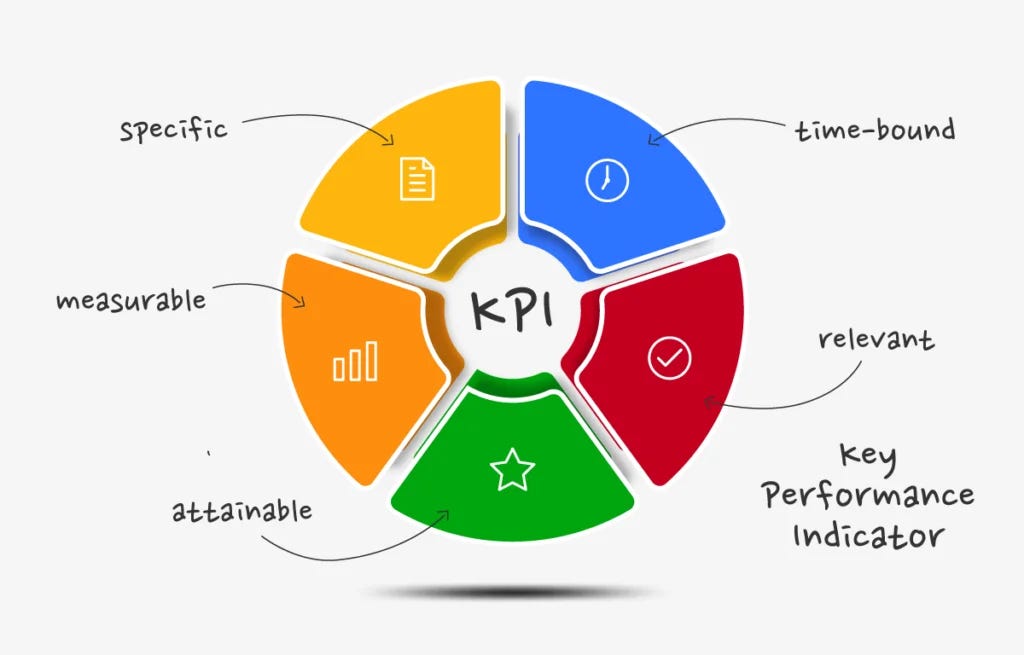

For years, the finance playbook has centred on Key Performance Indicators (KPIs) – revenue growth, EBITDA margin, ROCE, DSO, inventory turnover, leverage ratios etc. While they remain essential, in a world shaped by AI, real-time data, and relentless volatility, they are no longer sufficient. KPIs reflect historical outcomes, whereas Boards now expect CFOs to articulate forward-looking insights.

That shift is driving a quiet but profound transition: from traditional KPIs to Predictive Performance Indicators (PPIs) – forward-looking metrics built on analytics and AI that estimate the probability of future outcomes.

Why are CFOs moving beyond KPIs

Three macro trends are pushing CFOs toward predictive metrics:

a) AI and predictive analytics have gone mainstream

Globally, a 2024 Deloitte survey found that 72% of organizations are already using predictive analytics to drive business decisions, and 45% report significantly better decision accuracy as a result.

According to a report by Gartner, the global predictive analytics market is projected to reach $10.95 billion by 2025, growing at a CAGR of 21.7% from 2020 to 2025.

Among finance teams using AI, 47% are using it specifically for predictive modelling – not just descriptive reporting.

This means the tools to build PPIs are no longer experimental – they are available and being applied at scale.

b) CFOs are explicitly prioritizing metrics and analytics

In an October 2024 global survey of 251 CFOs, Gartner found that “metrics, analytics and reporting” is the top focus area for 2025, overtaking finance transformation initiatives. AI adoption in finance ranked among the top priorities as well.

In other words, CFOs are no longer satisfied with more reports; they want better foresight.

c) The financial analytics market is exploding

Multiple market studies estimate the global financial analytics market at roughly USD 10–11 billion in 2024–25, projected to more than double by early 2030s, with a CAGR of around 10–12%.

How are CFOs using Predictive Intelligence

PPIs integrate historical data, behavioral dynamics and external intelligence to project future outcomes. Instead of reflecting the past, they illuminate what lies ahead by providing a predictive radar that enhances and extends traditional KPIs.

Today’s PPIs are predominantly from the below mentioned interconnected domains:

FP&A

Risk & Compliance

Operations

Commercial Intelligence

Workforce Intelligence

Strategic / External Intelligence

PPI Maturity Model — The 5 Stages:

Stage 1: KPI-Driven Reporting (Reactive Finance)

Focus on historical KPIs; reporting is backward-looking and manual.

Stage 2: Diagnostic Analytics & Advanced KPIs

Organization understands drivers and root causes; still relies on past data but with deeper insight.

Stage 3: Experimental PPIs & Pilot Models

Predictive models are piloted using AutoML or data science, but not yet embedded in business routines.

Stage 4: Embedded PPIs in Decision-Making

PPIs are integrated into dashboards and performance reviews; predictive insights drive actions.

Stage 5: AI-Augmented Predictive Finance

Real-time PPIs, continuous model retraining, AI copilots, automated workflows; predictive intelligence underpins strategy.

Examples of the high-impact PPIs:

These PPIs focus on systemic risk, capital allocation, operational resiliency, regulatory exposure, and strategic foresight — the areas where predictive intelligence creates the highest enterprise impact.

The CFO’s Economics of Reducing Uncertainty Through Prediction:

PPIs improve enterprise value because they reduce the cost of uncertainty — one of the largest hidden expenses in modern organizations. When companies lack foresight, they increase buffers, delay decisions, overspend on risk mitigation, and misallocate capital.

1. Prediction reduces buffer costs

Companies with strong predictive planning reduce safety-stock and working capital buffers by 15–30%, according to multiple supply-chain studies (FMCG & retail sectors).

Demand-forecast accuracy improvements of 20–50% reported in FMCG and retail directly lower excess inventory and carrying costs.

2. Prediction improves capital allocation efficiency

McKinsey research shows companies that use predictive analytics in resource allocation achieve up to 30% higher returns on invested capital due to early identification of weak or low-probability bets.

Predictive revenue and margin models help CFOs shift capital toward high-confident opportunities faster.

3. Prediction reduces volatility costs

Volatility creates hidden financial penalties:

Last-minute borrowing, costly working-capital financing, emergency procurement, rush logistics.

A study on treasury digitalization shows AI-based liquidity forecasting improves cash-flow accuracy by 20–40%, reducing reliance on expensive short-term funding.

4. Prediction lowers the cost of operational surprises

Unplanned downtime costs manufacturers 10–20 x more than planned maintenance. Predictive monitoring reduces unplanned downtime by up to 30% in manufacturing.

5. Prediction accelerates decision speed (the overlooked economic lever)

Bain & Company reports that companies that make faster decisions outperform peers by up to 5 x in revenue growth and shareholder returns.

PPIs compress decision-cycles by giving CFOs early visibility into risk curves.

The transition from KPIs to PPIs is not merely a technological evolution — it marks a fundamental shift in how organizations understand performance, risk, and value creation. As predictive intelligence becomes embedded across finance, supply chain, commercial, and risk functions, the CFO emerges as the organisation’s architect of foresight.

The future belongs to companies that sense change early and respond with speed and confidence. PPIs give finance leaders the ability to see beyond the horizon and build organizations that are not only prepared for the future, but poised to shape it.

A very timely read.. thank you for sharing