“Beti Vivaah” leveraging “Digital India and Tax Law changes” for Women’s Empowerment.

Marriage an Institution in India

Marriage in India is a deeply entrenched social and religious institution that is evolving under modern influences. It functions as a sacred ceremony, a crucial societal methodology for family formation and property inheritance, and a legally recognized union of two Souls . Marriage is not a one-size-fits-all institution in India. Personal laws specific to several religious communities, such as Hindus, Muslims, Christians, Sikhs, and Parsis, influence it.

Wedding Industry in India

The scale of the wedding industry In India is huge and monumental across communities and religions; it is having a religious and cultural significance in people’s lives and way of community living. Though it’s a one big lifetime event for both the Bride and the Groom’s Family, the brunt of most expenses is still traditionally borne by the bride and her family, in almost majority of the weddings in India, though co-sharing or partial sharing of expenses by the groom and family is also prevalent in most educated and progressive communities in India.

The Indian wedding industry is a colossal market, estimated to be worth over $130 -$140 billion annually, driven by lavish celebrations, a high volume of weddings (around 8-10 million per year), and significant spending on aspects like jewelry, apparel, venues, and hospitality. Key trends include the growth of destination weddings, increased use of technology for planning, and a shift towards more personalized and experience-driven celebrations.

While what is common across most Indian Weddings is :

The Girls’ parents and the girl (even if educated and earning) end up saving big for that one event called Marriage where it’s obligatory to perform spends for a few rituals and customs in many communities and regions across India. While saving lifetime for this 3 day to a One-week ceremony spend, gets precedence over parental spending on the Girls education /higher education and a reason for not usually allowing family capital to be transferred to the girl, though many legal changes in recent decades, allow inheritance in ancestral property for Girls even after Marriage.

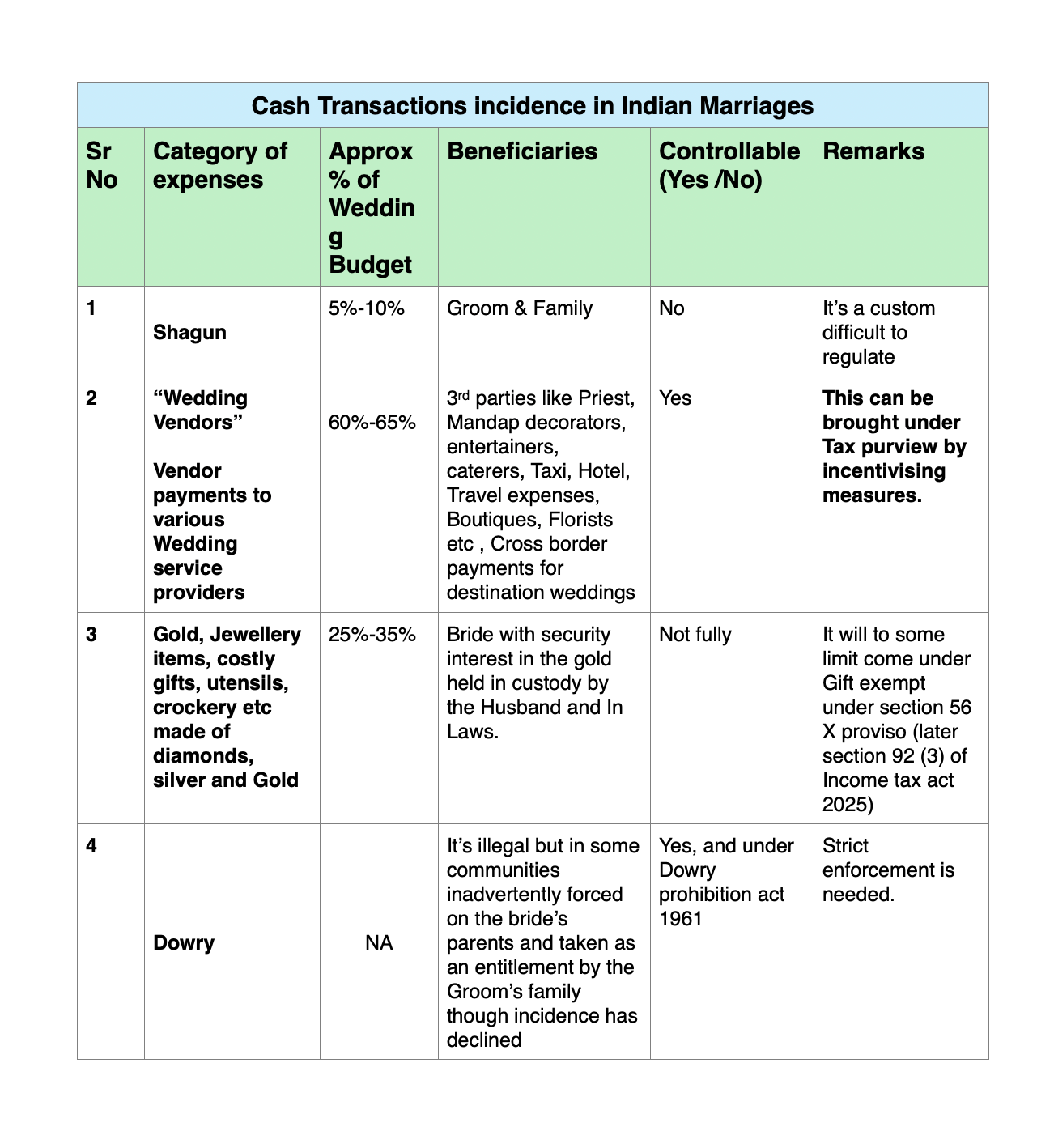

Every Wedding season comes with a high incidence of Cash Transactions which essentially fails to curb incidence and practice of black money circulation if unchecked and split into categories- controllable and non-controllable.

UN Sustainable Development Goal 5- Gender Equality

UN Sustainable development goal speaks about Goal 5A – where Countries Undertake reforms to give women equal rights to economic resources, as well as access to ownership and control over land and other forms of property, financial services, inheritance and natural resources, in accordance with national laws. Also, Goal 5B seeks to Enhance the use of enabling technology, in particular information and communications technology, to promote the empowerment of women.

While a lot has been done by Indian govt in various initiatives last 11 years in particular with schemes like a) Beti Bachao Beti Padhao b) Sukanya Samriddhi Yojana c) Lakhpati Didi Yojana d) Doubling of Maternity leave e) Steps to stop Triple Talaq g) Ladli Behna h)Free bus rides etc and many other initiatives, yet the key issue of Capital formation with women remains unaddressed and the event of a wedding ceremony, presents an opportunity to empower women’s capital formation by Tax law changes .

Women’s Empowerment thru Digital India and Tax Law changes

Hence to mitigate Cash transactions and unaccounted money in Marriage industry and help create capital for Women, digital spends on marriages can be enforced thru progressive changes & Incentives in Direct Tax Laws of India with a few checks and balances. The collateral impact being bringing a large stream of Wedding Vendors into the Taxpayer Base and Tax on them will be determined in Year 1 of the spend done by the Bride or her Parents /Relatives, while Govt’s outflows wud be on a lower scale thru deduction benefits to women taxpayers, will happen over 10 financial years and only after meeting some guidelines.

For finalising the Tax deduction or incentive for digital payments and which can form basis for women’s capital formation after Marriage, its essential to also create a legal framework for same.

One Marriage- One Marriage registration certificate, One Marriage Expense Certificate, norm to be established. The entire scheme applies only for the first Marriage of any Individual Girl. Also, within Muslim community, this deduction can be availed by only the first lawfully wedded wife (girl). The scheme applies only when the girl is 21 years of age at time of Marriage.

Marriage expense certificate to be linked to Aadhar and PAN card of Bride with PAN and Aadhar number of immediate parents of bride OR two blood relatives of bride (within the definition of relative as defined under the Income tax law, if immediate parents have expired) who can incur expenditure to “Wedding vendors” thru Digital Mode only . This certificate to be uploaded on Income tax portal after linking these numbers between the stakeholders electronically and called as “Marriage spend certificate”. Such certificate must be got certified by a practising CA with UDIN & Notarised, for filing on Income Tax portal under Income Tax forms. Thru the certificate upload mechanism, the parents expenses will get clubbed with the brides own for calculating the deduction benefit order. The Parents or relatives of bride will not be able to claim any deduction and their spends must be transferred to the Girls PAN number thru Income tax portal.

Open a Facility for “Wedding vendors” to obtain a TCS number on Income Tax Portal to collect TCS of 0.1% for such wedding payments. The control here is - If the TCS is not collected by the Wedding vendor, then in that event the Bride and family cannot claim the expense on the Tax portal. Vice versa, the Govt stands to gain, if wrongly collected by the vendor outside of marriage event.

All Service Providers who operate as “Wedding Vendors” in India, to get a TCS Collection facility thru a suitable subsection inserted in section 206(C ) of Income tax act 1961, (OR Chapter XIX of Income Tax 2025) where in these vendors wud collect a TCS at source on their invoices paid digitally only thru UPI, Net banking or Cards by the Bride or her Parents thru their Bank accounts designated so with their PAN and Aadhaar KYC. This TCS will reflect in the AIS /26AS statement of the bride or her parents/ specified relatives, paying on her behalf for Marriage expenses. The CA certificate filed will be verified by an independent Notary and Notarised for being available to upload. Each such marriage certificate must be uploaded on Income tax portal within 90 days of solemnising/ registration of Marriage.

Once all vetting is done by IT department, within 30 days of submitting such Audited expense certificate, the department can pass a “deduction allotted order” in the PAN of the bride in similar fashion like a 143(1A) order with suitable rules for appeal and revised filing allowed once.

If income is not declared by the girl (bride) in any financial year after Marriage, the deduction also cannot be availed and will be carried forward to the next financial year but not beyond 10 financial years after the financial year in which marriage is solemnised. Marriage expense Deduction is allowed only against Taxable income of the girl (Bride) under a specific section and basis the table below in point 8.

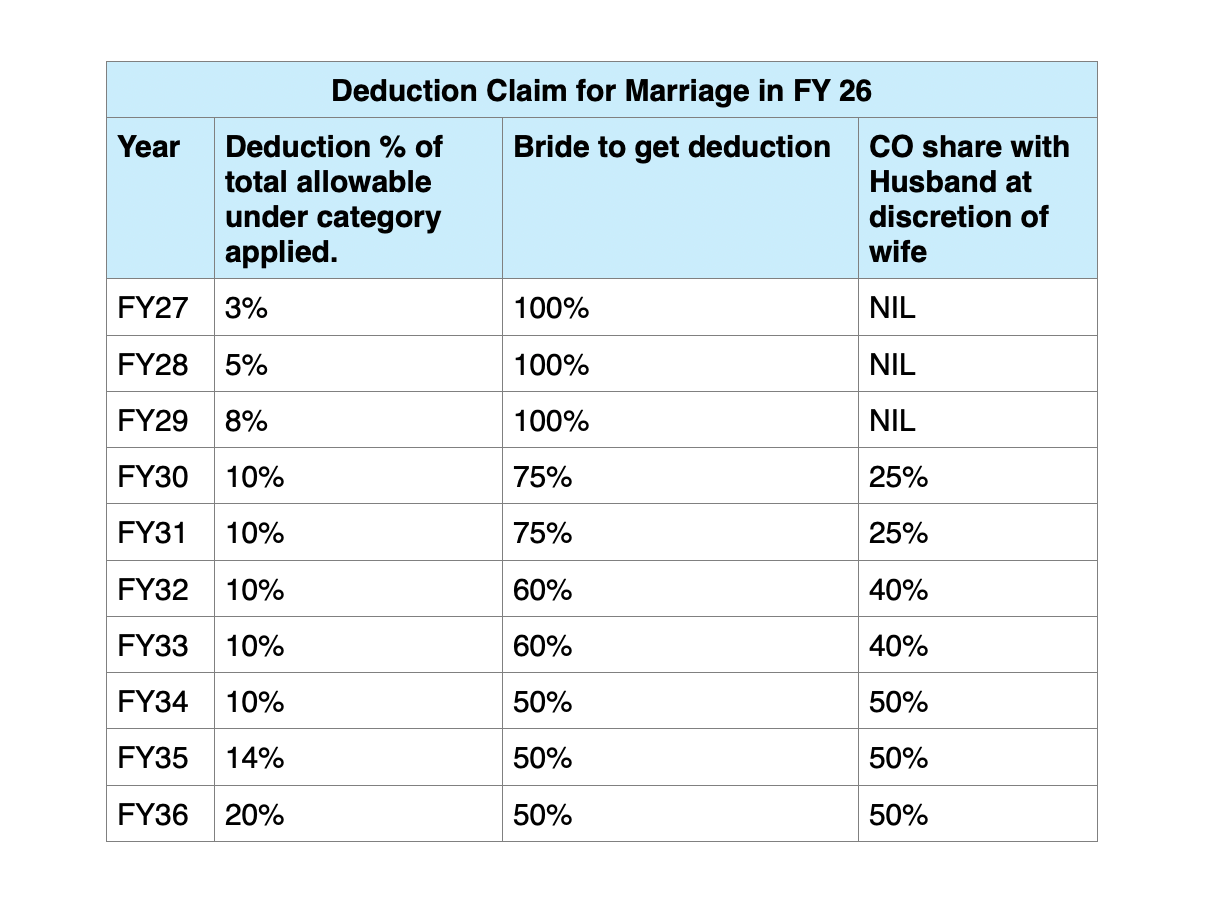

Claim for deduction can be made only by (Girl) Bride in her Tax return initially and later co share with Husband, after three financial years after the date of registration of Marriage mentioned in the expense certificate . If the marriage is solemnised in FY 26, the deduction is to be allowed for subsequent 10 financial years starting FY 27 on a proportion given in the Table below . The transfer can happen thru Income tax portal to Husband as per Table below and at each financial year at discretion of the wife.

This deduction to be allowed in increasing proportion for 10 financial years in following fashion. Year 1 is the financial year succeeding the financial year in which the marriage is solemnised. The bride (wife) must file a consent form on the Income tax portal for cosharing with husband. In event no such consent form is filed for a financial year, the bride will get the full deduction herself for that financial year when applicable after the 3rd year.

Note: The principle here is to allow the Marriage to settle down well before cosharing happens and the contribution of the bride to the husband is for the capital that she brings in to the in-law’s family after Marriage and will serve in long term a counterfoil to the menace of Dowry system faced by parents of several girls in India.

This deduction is allowed under even the new default regime u/s 115 BAC ( U/s 202 of ITA 2025) limited to the total amount allowed in category of taxpayers, after the Marriage is registered and only provided there is no divorce, separation or Talaq filed by the bride or any criminal case u/s 498 of Indian Penal code or corresponding section 85 or 86 of Bhartiya Nyaya Sanhita 2023 by her against the Husband. If during these 10 financial years any of this incidence happens, the deduction shall stand withdrawn for co share from husband. a) In the event of un-natural death of the bride (Girl) during the sustenance of the marriage, no deduction will be transferred to the husband or the child born out of the marriage. b) Even in case of Natural death, the deduction will be held by the Husband in trust for the child born out of the wedlock, and on the completion of 18 years of the child, the same will be given to the child for claiming a refund from Income tax department for higher education purpose.

Total deduction to be allowed is upto max INR 10 lacs or 50% of the spend on the Marriage done thru digital Mode to “Wedding vendors” whichever is lower for Salaried Taxpayers and where the bride or her parents have never declared income from Business or profession. This deduction upto 10 lacs will be available as per Table in point 8 above.

Higher deduction will be allowed to Bride and her parents/ relatives, who declare higher income from business and profession for 3 continuous financial years before the financial year in which the Marriage is solemnised and where Tax paid is in equal to or in excess of 100 lacs INR in the year preceding the Financial year in which Marriage is solemnised either by the Bride or her Parents /Specified relatives. This deduction will be upto a max of a) Rs 25 lacs OR b) 50% of actual spend thru digital mode to “wedding vendors” but not exceeding c) 25% of the Tax paid in previous financial years.

Provisions of section 56 of Income tax act 1961 (section 92 of Income Tax 2025) will govern other gifts including Gold, Jewellery etc.

For cross border spends to qualify for deduction, above limits will apply and only spends done thru Indian Credit cards will be allowed provided the remittance of such card dues is made in INR.

In Conclusion, this reform will help Women’s empowerment by providing the women a capital asset in form of tax deduction available and reduce the menace of Dowry, black money circulation with added benefit of increasing Tax payer base as the trend will be to pay marriage expenses digitally instead of cash.

Article By

Sandeep Deshpande, Group Chief Financial Officer

PMEA SOLAR TECH SOLUTIONS LIMITED